BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) INDUSTRY

The BFSI sector of India is historically regarded as one of the most stable systems across the globe, even with global upheavals, as quoted by the Invest India. The Government of India is continuously striving in the promotion of financial annexation in the banking sector through initiatives that are targeted primarily to bring the India’s underbanked population under the banking array. The banking sector of India is broadly fragmented into public sector banks, private sector banks, foreign banks, and regional rural banks. As per Invest India, the Indian banking industry comprises 27 public sector banks, 21 private sector banks, 49 foreign banks, and 56 regional rural banks. Along with these, the country consists of 1,562 urban cooperative banks and 94,384 rural cooperative banks. In fiscal year 2019, the public and private banking sector were $1422.9 billion and $741.8 billion, respectively. During April 2000-December 2019, around $80.7 billion of FDI inflows were attracted under the service sector (finance, banking, insurance, non-fin/business, outsourcing, others).

Banking Sector

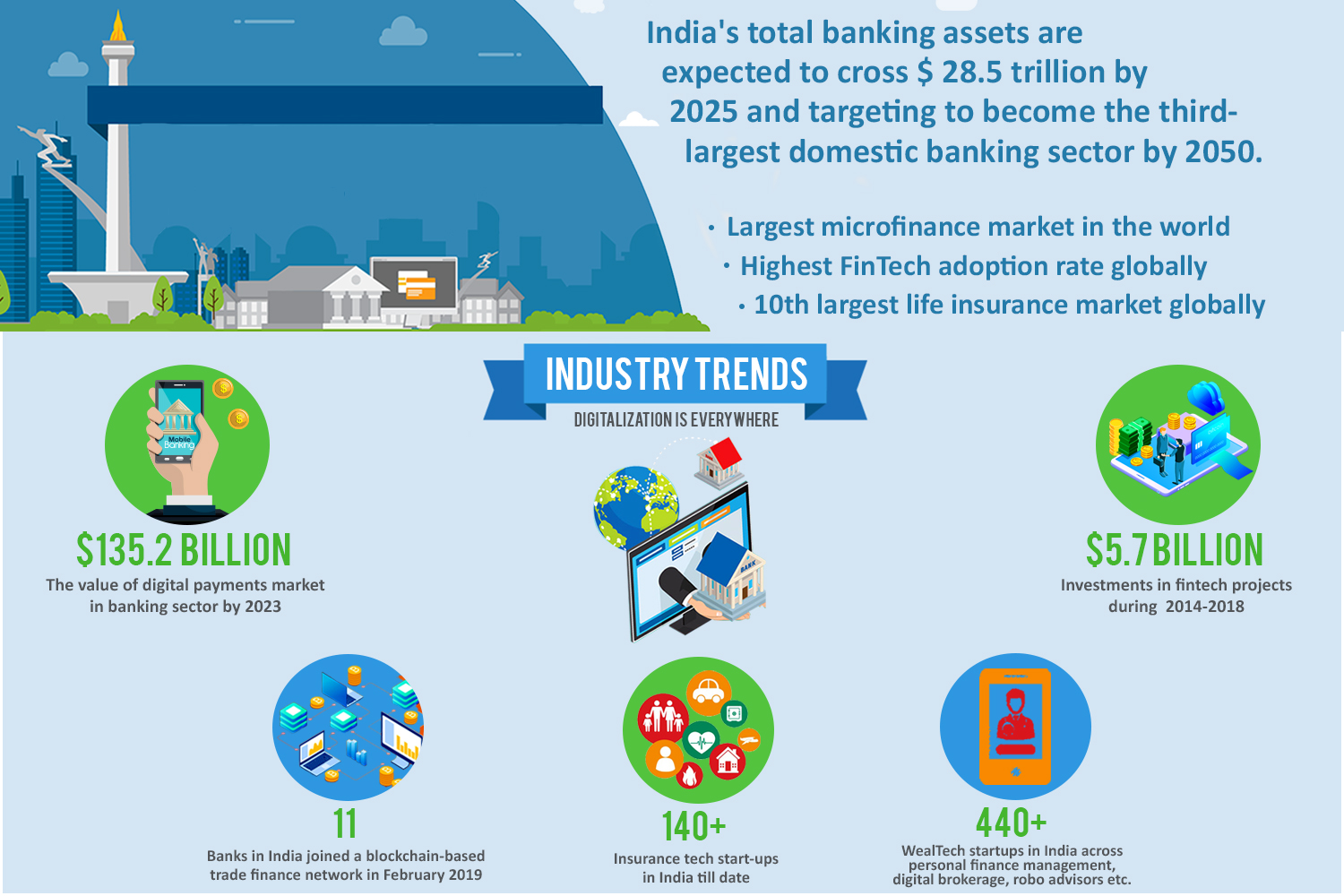

Indian banking industry is envisaging a growth with few industry trends in the market, which includes mobile banking, blockchain, cloud banking, and banktech. As per Invest India, the digital payments are expected to get doubled to $135.2 billion by 2023. In addition, around 11 banks in India have joined a blockchain-based trade financing network in 2019. These trends are supported by the Government of India through subsidies tax incentives to the fintech players to encourage the adoption of digital solutions in their banking systems. The fintech sector is considering India a potential market for expansion due to the availability of large untapped region and the favorable government support for digital banking. In May 2019, Niti Aayog, a policy think tank of the Government of India, calls for an open banking approach in India to end data monopoly. The competition in the banking industry has been reported owing to the significant presence of both local and foreign banks. According to CFA Institute, Paytm had raised $1,400 million and PhonePe funding amount to $500 million in 2017 in India for the development of fintech platforms. Around 29 startups out of 78 are currently working in fintech space in the country.

Realizing the potential of digital transactions in the banking sector, funding is being made quickly which is helping in the exploration of technology in every potential area of the banking sector. The increasing investment in the fintech sector has reported in India. As per the Invest India, Indian fintech market is estimated to jump from approximately $65 billion in 2019 to $140 billion in 2023. Nearly $5.7 billion investments in fintech were reported during the period, 2014-2018. Major segments within the Indian fintech space include Digital Lending, Digital Payments, InsurTech, BankTech, and WealthTech.

Insurance Sector

Indian insurance industry is governed by the Insurance Regulatory and Development Authority of India (IRDAI). At present, there are around seven health insurance and 23 general insurance companies that are engaged in offering health insurance products in India. It consists of 57 insurance companies, in which 24 are engaged in life insurance business and 33 are non-life insurers. Health insurance contributes 20% to the non-life insurance business, making it the second largest portfolio in the Indian insurance industry. Ayushman Bharat - National Health Protection Mission (AB-NHPM) is the largest health scheme by the Government of India. India is the tenth largest life insurance market across the globe. Among the life insurers, Life Insurance Corporation (LIC) is the sole public sector company.

Fintech and Financial sector

India is considered as one of the fastest growing FinTech markets across the globe. The sector consists of commercial banks, non-banking financial companies, insurance companies, pension funds, mutual funds, co-operatives, and other smaller financial entities. The Government of India has introduced several reforms to regulate, liberalise, and enhance the finance sector of the country. The Government and Reserve Bank of India (RBI) have taken several measures to facilitate easy access to finance for Micro, Small and Medium Enterprises (MSMEs). These measures include unleashing Credit Guarantee Fund Scheme for Micro and Small Enterprises, along with issuing guideline to banks regarding collateral requirements and setting up a Micro Units Development and Refinance Agency (MUDRA). In addition, the digital payments have been the flag bearer of the Indian FinTech industry. As per Invest India, the digital payments value of $65 billion in 2019 is expected to grow at a CAGR of 20% till 2023. There are several key trends noticed in the industry, which includes introduction of “Cashless India”, under which around 3.7 billion transactions were processed using Unified Payments Interface (UPI). Consequently, it ca be said that India has a diversified financial sector which is rapidly undergoing rapid expansion, both in terms of strong growth of existing financial services firms and new entities entering the market.