Indian Electric Battery Market Size, Share & Trends Analysis Report, Forecast Period, 2021-2027

The Indian electric battery market is mainly driven by the increase in the adoption of the electric battery in electric vehicles. The rise in the demand for fuel-efficient, high-performance, & low-emission vehicles, and stringent government rules & regulations toward vehicle emission is a major factor propelling the Indian electric battery market. The market is also driven by increasing awareness regarding electric vehicles (EVs) across the globe. Kerala aimed to put 1.0 million electric vehicle units by 2022 and 6,000 electric buses in public transport by 2025. Additionally, Telangana aimed to achieve 80% sales targets for 2 and 3-wheeler, 70% for commercial cars such as Ola and Uber, 40% for buses, 30% for private cars, and 15% for electrification of all vehicles by 2025. Further, the rising environmental concerns will continue to boost electric mobility, which is expanding at a rapid pace.

Besides, electric batteries are used in remote controls, torch, wall clocks, flashlights, hearing aids, digital cameras, mobile phones, automotive batteries, video game gadgets, remote control cars, home maintenance tools, smartwatches, remote controls, toys, and photographic equipment and many other devices. There is an increasing demand for wearables in the country due to the use of electricity, smartwatches, and TV in India. For instance, according to India Brand Equity Foundation (IBEF), consumer electronics held the highest market share of 29.7% in the total production of electronic goods in India. Furthermore, the electronics market in India is anticipated to reach $400 billion by 2020.

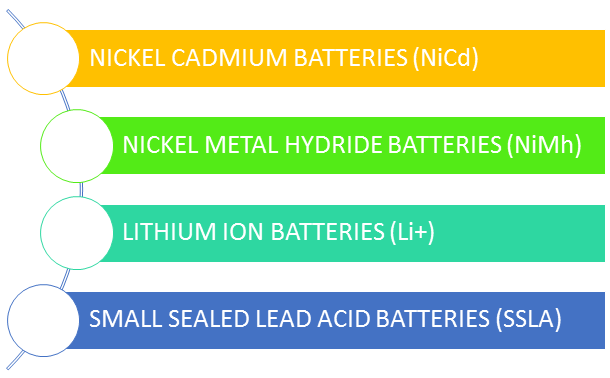

Types of Electric Battery:

There are four types of electric batteries including NiCd, NiMh, Li+, and SSLA (as mentioned in the figure above). Among these Li-ion batteries are used in a wide range of applications including EVs, consumer electronics, medical devices, toys, and drones. It also has various industrial applications for power sources and backup. With the increased adoption of green energy, Li-ion batteries are finding huge applications, especially in solar energy. Some of the major factors for the growth of the Li-ion battery market include rising green energy demand and significant growth in the drone market. Considerable growth in consumer appliances and toys is also driving the Li-ion battery market all across the globe. Advantages of the battery such as low self-discharge level and longer shelf-life as compared to other battery alternatives are making it preferable over its alternatives. However, lithium-ion batteries are expensive. The usage of relatively rare metals contributes to the high cost of lithium-ion batteries. Elon Musk, the CEO of Tesla Inc., announced in September 2020 that the company's battery cells and packs will be reduced in price, to sell cars for $25,000 or less. It is likely to open up new market prospects.

Government Schemes and Initiatives

The Indian Government has also taken certain initiatives to support the development of the charging infrastructure.

- Under Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) phase II, the government has allocated around $145 million for EV charging infrastructure. The fund is allotted for the next three financial years from April 2019 to April 2022, with a ratio of 3:4:3. Under the scheme, the government has planned to develop 2,700 charging stations in metros, and other cities that have a population of more than a million to build at least one charging station in a grid of 3 km x 3 km or 9 sq. km.

- In March 2019, the FAME 2 scheme was launched with a budget of Rs 10,000 crore (US$1.39 billion) to grow the commercial vehicle fleet.

- In Indian government established a National Mission on Transformative Mobility and Battery Storage, which would last through 2024 and will be a year-by-year phased manufacturing program (PMP).

- In March 2019, the government has announced plans to establish a National Mission on Transformative Transportation and Battery Storage to "promote clean, connected, and shared mobility" activities. A five-year phased manufacturing program (PMP) for a few large-scale, export-competitive integrated batteries and cell-making Giga facilities in India would be drawn out by the mission through 2024. According to the Niti Aayog analysis, India will require a minimum of 10 GWh of solar energy by 2022, with a target of 50 GWh by 2025. The program would also promote manufacturing localization throughout the fully electric car value chain.

Investment Trends

- The largest commercial oil business in India, Indian Oil Corporation Ltd., announced cooperation with Phinergy, an energy start-up, to develop and construct breakthrough metal-air batteries, a viable solution for long-distance electric-vehicle travel, on February 4, 2020. Aluminum-air (Al-air) and zinc-air technologies are Phinergy's specialties. Research and development, customization, manufacture, assembly, and sale of energy systems are all part of the cooperation.

- In August 2019, Tesla and China's Contemporary Amperex Technology Co. Ltd (CATL) expressed an initial interest in the Indian Government's plan to build plants to produce lithium-ion batteries, with an investment of around $6.95 billion. According to the NITI Aayog, India will require 6.0 gigawatt-scale plants (each with a capacity of 10GWh) by 2025 and 12 by 2030. While the base scenario does not account for possible export markets, it predicts 11 Giga plants by 2025 and 24 by 2030.

- To boost the sale of electric vehicles, the Goods and Services Tax Council voted to reduce taxes on electric vehicles and chargers beginning August 1. Tax refunds of up to Rs 1.5 lakh (US$2,085) on interest paid on loans to buy electric vehicles were announced in the budget, with a total exemption benefit of Rs 2.5 lakh (US$3,475) throughout the loan period. In addition, it was also announced that the removal of customs duties on lithium-ion cells, which will assist to reduce the cost of lithium-ion batteries in India, given they are not manufactured in the country.

- In 2019, Exide Industries and Leclanché formed a 75:25 joint venture in Gujarat to manufacture lithium-ion (Li-ion) cells, modules, and battery packs. The Li-ion cell production unit started its operations in mid-2020.

- Amara Raja Batteries approved the establishment of a greenfield automobile battery in August 2018 worth US$ 99.74 million with a 6.5 million-unit-per-year production capacity. In October 2018, the business gradually increased the plant's capacity to 10.8 million units.