India API Industry

Indian pharmaceutical industry is gaining momentum owing to significant contributions from generic brands, a wide range of API manufacturers, and robust demand for API post-COVID-9 pandemic. India is the largest provider of generic drugs around the globe. It supplies over 60.0% of the global demand for vaccines, 40.0% of the generic demand in the US, and 25.0% of all medicines in the UK, as per India Brand Equity Foundation (IBEF). APIs are now mostly imported from other emerging and developed markets in the country.

As per Invest in India, India’s share of the global API supply by volume is around 20.0% of the global market. API development, robust manufacturing, cohesive government policies, and strategic sourcing partnerships are essential to India’s pharmaceutical industry's success. The Indian API industry has evolved from being recognized as an industry manufacturing simple ‘API molecule’, to becoming the preferred destination for manufacturing the high value and complex APIs. The bulk drug industry is also dominated by MSMEs, which are the primary employment generators in the Indian pharmaceutical industry.

Indian API industry comprises a network of over 10,500 manufacturers and 3,000 pharma companies and holds the highest share in the generic drug market. Indian API industry is rapidly changing and there are various vital factors influencing these changes. India has more than 262 API plants, which is the largest number of US-FDA compliant pharma plants outside the US. India has around 1400 WHO-GMP approved pharma plants, 253 European Directorate of Quality Medicines (EDQM) approved plants with modern state of the art Technology which makes it attractive destination for pharmaceutical market players.

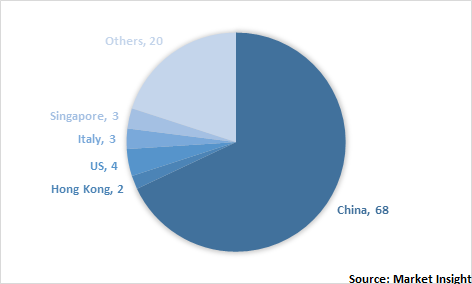

India API import to various countries (%), 2019

India is gaining huge importance in API outsourcing across the globe owing to cohesive regulatory policies, favorable government initiatives, and growing investment from foreign market players. Globally, India is one of the top suppliers of bulk drugs and formulations. It has the highest number of US FDA approved plants (665) outside the US as well as 44.0% of the global abbreviated new drug applications (ANDA). Moreover, the API contract manufacturers are expanding their production facilities to meet the clients’ demands. These contract manufacturers include Lonza Group Ltd., Natco Pharma Ltd., and Olon S.p.A. For instance, in April 2019, Olon S.p.A., an API CDMO declared the acquisition of a manufacturing facility in Mahad, India. With this acquisition, the company has finalized its 3 years’ development plan that will play a crucial role in API manufacturing. With the new company named Olon API India Pvt. Ltd., Olon is aiming to increase the presence in India.

Sun Pharmaceutical Industries Limited is one of the significant companies in the API market in India. It manufactures and markets generic and branded formulations and active pharmaceutical ingredients (APIs) in India and global markets. For API, the company provides anti-cancers, steroids, peptides, sex hormones, and controlled substances. The company manufactures APIs in 14 units, located in Hungary, Israel, India, and the US. Some of the company’s major API products include Abiraterone acetate, Acitretin, Anastrozole, Azacitidine, Bosentan Monohydrate.

Initiatives by the Government of India

Indian pharmaceutical industry suffices over 50.0% of the global demand for various vaccines, 40.0% of generic demand in the US, and 25% of all medicine in the UK. India is the second-largest contributor to global biotech and pharmaceutical workforce. The Indian pharmaceutical sector was valued at $33 billion in 2017. The government of India unveiled ‘Pharma Vision 2020’, aimed at making India a global leader in end-to-end drug manufacturing. The government plans to allocate $70 million for local players to develop Biosimilars. In March 2017, the government decided to create a digital platform to regulate and track the sale of quality drugs, and it can be used by people living in the country as well as abroad.

Upcoming Trends in the Indian API industry

The continuous expansion of bulk drug plants has been observed in India, which are expected to encourage in-house production of APIs, and will considerably reduce the dependency of India on China to import API. In March 2020, the Government of India approved a package, comprising four schemes with a total budget of INR 13,760 crore ($18 billion) to promote the in-house production and exports of bulk drugs and medical devices. The Union Cabinet approved an outlay of INR 9,940 crore ($13.2 billion) for bulk drugs. Further, the government in various states are acquiring land for setting up pharma parks to promote domestic manufacturing of APIs.

The COVID-19 crisis has surged the price of imports. For Indian drug makers, the price of several pharmaceutical ingredients has spiked after the outbreak of COVID-19 pandemic in the country. Since January 2020, the price of various conventional antibiotics such as Azithromycin has increased by at least 50.0%. Moreover, the Government of India took several steps to prevent and alleviate the shortage of essential drugs. The government set a bar on the export of around 26 APIs to counter the shortage of essential medicines in the country. Further, in March 2020, the government announced an INR 9,940-crore ($13.2 billion) package for bulk drugs, involving a production-linked incentive scheme of INR 6,940 crore ($9.2 billion), and setting up of three bulk drug parks of INR 3,000 crore ($4.0 billion). India is set to focus on antibiotics such as penicillin, as China being the sole manufacturer has also started manufacturing intermediates from penicillin, which has made the production of intermediates uneconomical in India.

Global API Industry

The API market has seen unprecedented growth globally, with the continuous increase in the development of biological APIs, an increase in demand for API packaging, and a rise in the demand for abbreviated new drug applications (ANDA). Moreover, API packaging generates a significant amount of revenue for the pharmaceutical industry. Even though the API market is led by the captive manufacturers presently, the companies are expected to partner with contract manufacturers in due course, in order to overcome the challenges of the complex manufacturing process and costly in-house API manufacturing and increasing competition.

- One of the leading manufacturers of APIs globally is TAPI (Teva Active Pharmaceutical Ingredients). Specializing in a range of API-related fields, TAPI works in areas such as chemical fermentation, synthesis, chromatography, and plant extraction and has the industry’s largest portfolio of over 300 API products.

- Dr. Reddy’s is another leading manufacturer with 60 APIs for drug use, diagnostic kits, and biotechnology products. Aurobindo and Cipla manufacture 200 APIs each, exporting their products to well over 200 countries worldwide.

The current global API supplier base consists of hubs in which manufacturers are specialized in producing different types of ingredients for separate sections of the pharmaceutical market. For instance, China has a reputation to produce high volume, low-cost ingredients. Globally, the API industry is entering a new growth phase, which includes new regulations, patent expiry, among others. Moreover, the API industry is experiencing an unprecedented growth due to the escalation in market dynamics of competition and consolidation. Regardless of where the APIs are made, the pharmaceutical companies are required to adhere to safety and quality standards that have been set up by the country where they are imported. Similarly, if the API is intended for use in Europe, it is required to meet regulations set by the European Medicines Agency. A regular inspection outside the country of use, however, it can prove difficult with counterfeiting and contamination being high on the list of various agencies’ concerns.