Indian Pharmaceutical Industry

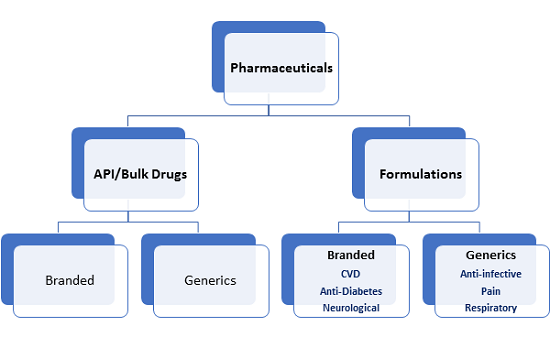

The global pharmaceutical industry includes biological, medicinal, and pharmaceutical products in various forms, such as tablets, capsules, ampoules, ointments, powders, solutions, and suspensions. The overall pharmaceutical market is segmented into prescription-based products and over-the-counter medications. In addition, it can be segmented into branded drugs and generic drugs.

Structure of the Global Pharmaceutical Industry

The aging population has been increasing over the years along with which the age-related chronic diseases have also been increased. This has provided the global pharmaceutical industry with an opportunity to serve the increasingly aging population in developed economies coupled with the growing middle-class population in emerging economies. This target population has provided a larger customer base for operators in the global pharmaceutical industry. Furthermore, the growing global middle-class population provides growth opportunities, provided increased access to pharmaceutical products. Moreover, the increasing prevalence and incidences of chronic diseases such as cardiovascular diseases, cancer, diabetes, chronic kidney diseases, and many others have increased the demand for drugs, which has impacted the global pharmaceutical industry. In addition, the recent COVID-19 outbreak has created an urgent need for the development of a vaccine against the virus.

Top-Selling Drugs in 2018

The biggest-selling drug in 2019 was, Humira (AbbVie Inc.), with sales reaching around $19.2 billion. Since it was launched 16 years ago, this drug has generated cumulative sales of $133.0 billion. Humira was the first ‘humanized’ mAb to be approved by the FDA and is indicated to treat autoimmune diseases such as Crohn’s disease, rheumatoid arthritis, and psoriasis.

| Drug | Primary indication | Marketer | Sales ($ Billion) |

| Humira | Arthritis | AbbVie | 19.2 |

| Keytruda | Advanced melanoma | Merck & Co., Inc. | 11.1 |

| Revlimid | Multiple Myeloma | Celgene Corp. | 9.7 |

| Eliquis | Stroke/Blood Clots | Bristol-Myers Squibb | 7.9 |

| Avastin | Cancer | Roche | 7.3 |

| Opdivo | NSCLC | Bristol-Myers Squibb | 7.2 |

| Herceptin | Cancer | Roche | 6.6 |

Source: Company Websites and OMRAnalysis

Indian Pharmaceutical Industry

India with an established domestic pharmaceutical industry is among the leading global producers of cost-effective generic medicines and vaccines. The pharmaceutical industry in India produces a range of bulk drugs that account for roughly one-fifth of the industry output. The generic drug producers of India hold a strong position in the global supply chain and play a significant role in the pharmaceutical industry growth. Some of the major domestic players in the industry include Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, Cipla, Lupin, Aurobindo Pharma, Zydus Cadila, Piramal Enterprises, and Glenmark Pharmaceuticals.

Growth Drivers for the Indian Pharmaceutical Industry:

- Innovation and R&D: Development of new complex generic drugs, supplemented by the New Drugs and Clinical Trial Rules and the Atal Innovation Mission

- Medical Tourism: Quality services offered at marginal costs compared to the US, Europe, and South Asia

- Infrastructure Development: India has the highest number of US-FDA compliant pharma plants outside the US

- Strong Drug Manufacturing: Expertise in low-cost generic drugs and a movement towards end-to-end manufacturing

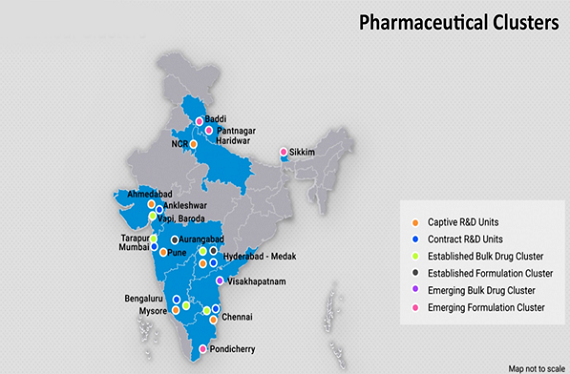

- Pharmaceutical Cluster: Andhra Pradesh, Gujarat, and Maharashtra are some of the major pharmaceutical clusters in the country

India is a prominent region and is growing its presence rapidly in the global pharmaceutical industry. It is the largest generic drugs providers globally and occupies around 20% of share in the global supply by volume. In addition, the country supplies 62% of the global demand for vaccines, according to the National Investment Promotion and Facilitation Agency. India is the only country that has the most number of pharma plants that comply with the US FDA (more than 262 including APIs) outside the US. In addition, the country has around 1,400 Pharma Plants approved by WHO-GMP while 253 EDQM ( European Directorate of Quality Medicines) approved plants. Moreover, the Indian API industry is ranked third largest globally, which contributes 57% of APIs to the prequalified list of the WHO.

There are more than 3,000 pharma companies in the country that too with a strong network of more than 10,500 manufacturing facilities. The domestic pharmaceutical market turnover reached around $20 billion in 2019, up 9.3% from 2018, growing significantly owing to the penetration of health insurance and pharmacies rise. The pharmaceutical industry in India is growing significantly owing to the increase in life expectancy coupled with the rising incidences of a number of chronic and infectious diseases. There is a gradually increasing demand for novel drugs which has surged the R&D investments in the pharmaceutical industry.

Recent Developments

- In August 2020, Raghava Life Sciences (RLS) received the approval for manufacturing and marketing the Favipiravir bulk drug. The Favipiravir anti-viral drug is prescribed for the treatment of COVID-19.

- In August 2020, Sun Pharmaceutical Industries Ltd. announced to soon start selling its version of Favipiravir.

- In June 2020, Roche Pharma India expanded its partnership with Cipla for further improving access to its key oncology medicines, trastuzumab (Herclon), bevacizumab (Avastin) and rituximab (Ristova) in India.

- In May 2020, Jubilant Generics Ltd. signed a licensing agreement with Gilead Sciences Inc. for manufacturing and selling COVID-19 drug Remdesivir in 127 countries, including India.

- In October 2019, the Government of Telangana has urged the Central government for providing financial assistance of INR 3,418 crore ($489 million) for Hyderabad Pharma City.

Government Initiatives

Some of the initiatives taken by the Government to promote the Indian pharmaceutical sector include:

- India plans to invest around INR 1 lakh crore ($1.3 billion) for encouraging companies for manufacturing pharmaceutical ingredients domestically by 2023.

- Under Budget 2020-21, the Ministry of Health and Family Welfare was allocated with INR 65,012 crore ($9.30 billion). The Government allocated INR 34,115 crore ($4.88 billion) to the National Health Mission to benefit rural and urban people.

- The government allocated INR 6,400 crore ($915.72 million) to the health insurance scheme Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) for 2019-2020. This is an INR 4,000-crore (around $572 million) boost from the last fiscal year.