Indian Cardiovascular Diseases Industry

Cardiovascular diseases (CVDs) are amongst the fatal diseases across the globe, accounting for over 25% of the total mortalities in India every year. The Harvard School of Public Health (HSPH) and the World Economic Forum (WEF) revealed that between 2012 and 2030, the total economic burden of non-communicable diseases in India is estimated to reach $1.7 trillion (INR 126 lakh crore). CVD includes high blood pressure, coronary artery disease, cardiac arrest, stroke, arrhythmia, congestive heart failure, peripheral artery disease, and congenital heart disease. The high blood pressure is the most prevalent in India. Therefore, there is a significant demand for anti-hypertensive drugs in the Indian CVD market. In conjunction with the management of high blood pressure, the chances reduces for the occurrence of other chronic health conditions, such as stroke, heart attack, or other complications.

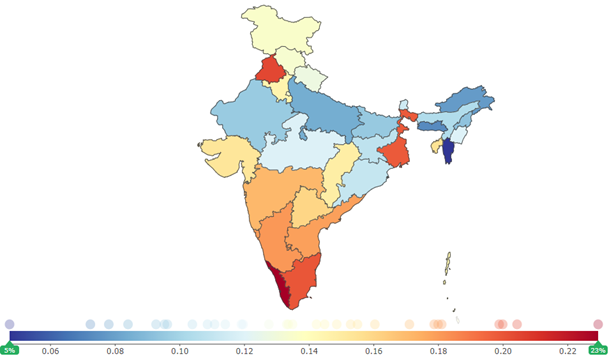

Cardiovascular Diseases, both sexes, all ages, 2017 (% of total DALYs (disability-adjusted life year))

Source: Institute for Health Metrics and Evaluation (Global Burden of Disease Study 2017)

As per the Institute for Health Metrics and Evaluation (IHME), CVD's risk factors have increased across all states in India between 1990 and 2017. In less developed Indian states, such as Bihar, Rajasthan, Meghalaya, Jharkhand, Uttar Pradesh, Assam, Madhya Pradesh, Chhattisgarh, and Odisha, the prevalence of the CVD is comparatively less, with the prevalence of the disease varied between 3,000 and 4,000 per one million population in 2017.

In July 2017, the Government of India introduced price controls on cardiac stents restricting the selling price to 70% lower than the prevailing market rate. The same order was followed by a similar pricing cap on knee implants later in 2017. The devices were price capped back then, which were later included in the National List of Essential Medicines (NLEM). There are around 23 medical devices, which have been notified as drugs and are regulated under the Drugs and Cosmetics Act. Of these, drug-eluting stents, cardiac stents, condoms, and intra-uterine devices are included in the NLEM and are subject to notified price caps.

MAJOR CATEGORIES IN THE CVD THERAPY

i) Lipid Medications (Statins)

ii) Angiotensin Receptor Blockers (Sartans)

iii) Beta-Blockers

iv) Anticoagulants

Statins or HMG-CoA reductase inhibitors are a class of lipid-lowering medications used to lower cholesterol levels by blocking the liver enzyme responsible for cholesterol production. As per OMR analysis, statins drug therapy accounts for nearly 25% of the Indian CVD drug market, owing to the growing generation of statins, such as Rosuvastatin and Pitavastatin's combinations. Further, patent expiration of some top-selling statins, such as Simvastatin and Atorvastatin, has created enormous opportunities for generic drug manufacturers in the country. Further, Sartans or ARBs are regarded as anti-hypertension drugs that reduce high blood pressure by blocking the effects of a hormone called angiotensin II, which is known to constrict blood vessels and retain body water. Sartans hold around 30% share in the Indian CVD drug market, as per OMR analysis. Sartans have been registering a considerable CAGR (2020-2026) among all types of CVD drug therapies, owing to the introduction of combinations of drug therapy, such as Telmisartan and Valsartan, and the growing demand for other Sartans such as Losartan and Olmesartan.

Whereas beta-blockers are used to treat various conditions such as hypertension, arrhythmia, chest pain, and migraine, among others. This CVD drug therapy accounts for nearly 20% of the Indian CVD drug market, as per OMR analysis. The major key players active in the Indian CVD drug market include Sun Pharmaceutical Industries Ltd., Torrent Pharmaceuticals, Ltd., Lupin, Ltd., USV Pvt., Ltd., and Glenmark Pharmaceuticals, Ltd. Company-wise, Sun Pharmaceutical Industries Ltd. is the largest player in CVD drugs with around 15% market share in the Indian CVD drug market in 2020.

India Taking Actions…

- The Indian Government has launched Ayushman Bharat, the world’s most massive government-funded scheme, in September 2018. It is a health premium program focused on providing affordable and better healthcare services to the country's people.

- In 2015, India became the first country to develop specific national targets and indicators to reduce the number of global premature deaths from non-communicable diseases (NCDs) by 25% by 2025.

- India’s National Monitoring Framework for Prevention and Control of NCDs demands a 50% relative reduction in household use of solid fuel along with a 30% relative reduction in the prevalence of current tobacco use by 2025.

- India has employed the WHO’s Framework Convention on Tobacco Control to reduce the demand for tobacco products in the country. India has restricted tobacco imagery in films and TV programs, prohibited tobacco products' sales around educational institutions, banned some smokeless tobacco products, and developed tobacco-free educational institutions guidelines.

MEDICAL DEVICE REGULATIONS IN INDIA

Central Drugs Standard Control Organisation (CDSCO) is a regulatory authority for the approval of medical devices in India. Medical device approval is a layered and lengthy process in the country. The CDSCO has introduced medical device guidelines and appointed its Central Licensing Approval Authority (CLAA) for medical device control. However, the CLAA has only classified a few devices for pre-market reviews, including cardiac stents, heart valves, orthopedic implants, and intraocular lenses.

Devices approved in the US, European Union, Canada, Japan, and Australia can legally be sold in India by submitting a technical dossier and getting necessary approvals. The medical devices manufacturers need to submit all the documents used to support prior authorizations with their application. Foreign manufacturers also need to obtain an importer license. Manufacturers who want to register their medical devices in India must supply evidence of prior regulatory authorization in the US, Canada, Europe, Australia, or Japan, with the proof of approval in their home market. Additionally, each manufacturing facility must be registered in their home market and each technical documentation must be submitted for review by the CDSCO.