Medical Device Industry

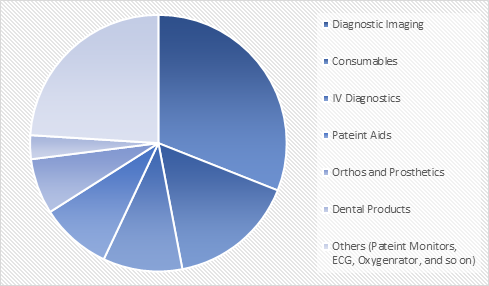

Healthcare sector is a key contributor to the growth of the Indian economy, regarding both employment and revenue. A medical device is any apparatus, appliance, or instrument required for the diagnosis, prevention, alleviation of diseases or for any other wellness purpose. Easy availability and accessibility of quality medical devices is the backbone of developed healthcare sector. As per the India Brand Equity Foundation (IBEF), in 2019, India was the fourth largest medical devices industry in Asia-Pacific region after Japan, China and South Korea. According to India’s Press Information Bureau, in 2019, the medical devices industry in India was valued at nearly $6.7 billion for 2018-19 and is expected to reach at nearly $11.7 billion by 2021-22. Diagnostic imaging, consumables, IV diagnostics, patient aids, ortho & prosthetics, and dental products among others are the major segments of medical devices industry in India. India is highly dependent on the import of medical devices the overall import dependency of India is around 75-80%. In 2018-2019, India registered net imports of medical devices of nearly $6.2 billion and net export of $2.1 billion. The country’s export of medical devices is projected to reach $10 billion by 2025.

Segmental Share of India’s Medical Device Industry

Indian medical device industry comprises both international and domestic market players. Accurex Bio-medical, Danaher Corp., GE Healthcare, Narang Medical, Philips Healthcare, Roche Diagnostics, and Schiller Healthcare among others are the key players operating in the Indian medical device industry. As per the Invest India, National Investment Promotion and Facilitation Agency of India, nearly 65.0% domestic manufacturers of medical devices operate in the consumables segment and cater the local consumption with limited exports of manufactured devices. In India, the high end technology in the medical device industry is led by big multinationals with support of their extensive service networks. According to Invest India, in 2019 there exist around 800 domestic medical devices manufacturers in India. In 2019, these manufactures had invested $2.3 million to $2.7 million in device manufacturing and its supply chain and had received average turnover of $6.2million to $6.9 million. Many medical device manufacturing parks have been established in the country due to consistent support of state-level policies for efficient domestic manufacturing of medical devices at lower costs. For instance, Andhra Pradesh, Telangana, Tamil Nadu, and Kerala are the major states that have received in-principle approval from Government of India in November 2019 to establish new medical devices parks in these states.

Dynamics of India’s Medical Device Industry

Drivers of India’s Medical Device Industry

India’s medical device industry is very dynamic and the key drivers impacting the industry include the rising disposable income and affordability; growing population along with changing diseases pattern; growing awareness towards wellness, preventive care and diagnosis; and rise in medical tourism owing to low cost of treatment. With the growing population, the demand for medical devices in India has also increased. According to the Federation of Indian Chambers of Commerce & Industry (FICCI ), India’s population is projected to reach 1.45 billion by 2028, making it the most populous nation across the globe surpassing China. With the growing urbanization and the changing lifestyle Indian society is becoming more prone to lifestyle-oriented diseases including cancer, diabetes, heart attack, and obesity among others. Rise in the number of patients of such diseases in the country is expected to create huge demand for medical device industry in the country. The geriatric population is more prone to such diseases. As per the report of UN, out of the total population, the share of aging population is projected to be 6% of the total population by 2021. The increase in geriatric population will further augment the growth of Indian medical industry. With growing foray of private players into healthcare, there is expected a growth in the number of hospitals, diagnostic centers and specialized facilities. Till 2019, 393 hospitals have got the National Accreditation Board for Hospitals & Healthcare Providers (NABH) accreditation in the last decade. The increase in such institutions is expected to create demand for standard medical devices which is anticipated to drive the growth of medical device industry in India.

Medical Devices shows/exhibitions held in India

The Department of Pharmaceuticals, Ministry of Chemicals & Fertilizers, Government of India along with the Federation of Indian Chambers of Commerce & Industry (FICCI) are the key organizations that actively participate in the shows and exhibitions regarding growth of the Medical Devices sector to offer accessible and affordable medical care to Indians. The Fifth Edition of the International Conference and Exhibition (INDIA MEDICAL DEVICE 2020) is one such instance. The above organizations have attended this three-day event, which was scheduled from March 5 to March 7, 2020 at Gandhinagar, Gujarat. The conference had offered a potential platform and opportunity for industry to articulate issues and areas where government's intervention is needed. The deliberations at the conference are expected to pave a path for the required transformation in the Indian medical device ecosystem. The holding of such shows or exhibitions in the country is expected to drive the growth of the medical device industry in India.

Government Support

The medical devices manufacturing is at its infancy stage in India. The government support is projected to bolster the growth of the country’s medical device industry. The “Make in India” is one such initiative that has motivated medical device manufacturers in India to increase their production of medical devices with the government support in the form of land allocation and subsidies to encourage growth of the domestic production of medical devices in the country. Under the new revised regime, in 2020, the Government of India has allowed 100% FDI under the automatic route for both brownfield and greenfield setups. Among all other categories, equipment & instruments, consumables and implants have attracted most FDI. Strong FDI inflows reflect the confidence of global players of medical devices in the Indian medical device industry.

In March 2020, the Government of India had announced a package of $1.89 billion to set up bulk drugs and medical devices parks in the country. Allocation of such huge funds to increase the production of drugs/APIs and medical devices, is giving a further boost to pharma manufacturing in India and attracting further investments in the sector.

Further, in March 2020, State Implementing Agency (SIA) had implemented Production Linked Incentive (PLI) Scheme to provide financial assistance for common infrastructure facilities for 4 Medical Device parks. The target for PLI Scheme is to assist about 25-30 manufacturers under the category of cancer care/radiotherapy medical devices; radiology & imaging medical devices and nuclear imaging devices; anesthetics & cardio-respiratory medical devices; and aII the implants including implantable electronic devices. As per the scheme incentive, incremental sales of 5% over the base year 2019-20 will be provided on the segments of medical devices identified.